At Traffic TV, our goal is to assist you in maximizing the benefits of digital marketing and confidently making choices. To achieve this, we feature various programs from our partners where we receive commissions for purchases made through links in this post. However, be assured that this partnership does not affect our assessments. Learn more here

In the dynamic world of digital banking, Relay Bank has emerged as a game-changer, redefining the standards of convenience, security, and innovation. As a leading figure in the industry, Relay Bank offers a unique blend of advanced technology and customer-centric services, catering to both individual and business needs. In this blog post, we’ll delve into exploring its history, core features, security measures, and much more. Whether you’re a potential customer looking to switch to a digital bank or simply curious about the latest trends in financial technology, this comprehensive guide will provide you with all the information you need about Relay Bank.

Table of Contents

Core Features of Relay Bank

Relay Bank stands out in the financial sector with its innovative approach to banking. Understanding its core features helps in appreciating how it revolutionizes the way individuals and businesses manage their finances.

1. Digital-First Banking Approach: At the heart of their services is its digital-first strategy. This approach prioritizes online banking, enabling customers to access their accounts, make transactions, and manage their finances from anywhere with internet access.

2. Automated Expense Tracking: Their offers advanced expense tracking features. These tools automatically categorize expenditures, making it easier for users to monitor their spending patterns.

3. Enhanced Security Features: Security is a top priority for them. They implement state-of-the-art encryption and multi-factor authentication to protect customer data.

4. Multi-Currency Support: For customers dealing with international transactions, they provides robust multi-currency support. This feature allows users to hold, manage, and exchange different currencies seamlessly.

5. Customizable Account Options: They understands that each customer has unique needs. They offer customizable account options, including various checking and savings accounts tailored to different user profiles.

6. Integration with Financial Tools: They seamlessly integrates with popular financial management tools and accounting software. This integration simplifies financial tracking and reporting for users.

7. Dedicated Customer Support: Beyond its digital tools, Relay Bank prides itself on its responsive customer support. Whether it’s through chat, email, or phone, they ensure that help is always available.

Conclusion: The core features of Relay Bank collectively aim to provide a seamless, secure, and user-friendly banking experience. They reflect the bank’s commitment to innovation and customer satisfaction in the digital age.

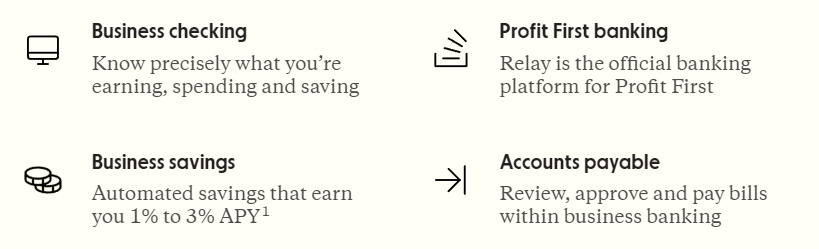

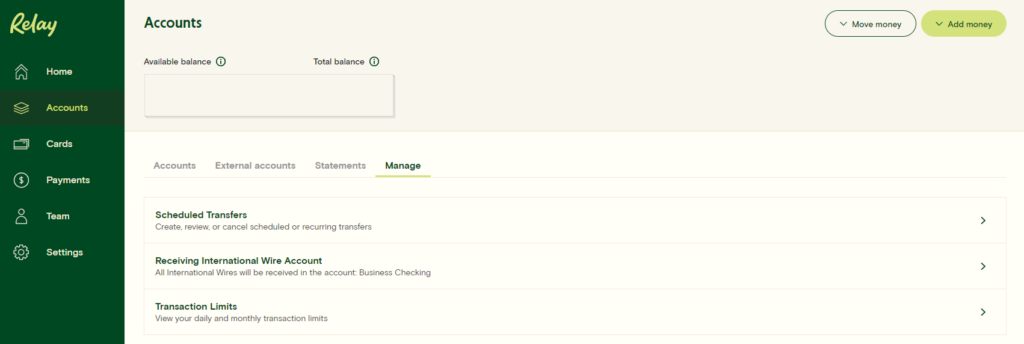

User Interface and Experience

When exploring the world of digital banking, the user interface (UI) and overall user experience (UX) are pivotal factors. Relay Bank, as a modern financial solution, places significant emphasis on these aspects. The focus is not just on functionality but also on ensuring a seamless, intuitive journey for its users.

Simplicity and Clarity: One of the hallmark features of their UI is its simplicity. The dashboard presents a clean, uncluttered view, making it easy for users to find what they need. This approach reduces the learning curve for new users and enhances the overall experience for all.

Responsive Design: In today’s mobile-first world, Relay Bank has embraced a responsive design. Whether accessing the bank on a desktop, tablet, or smartphone, the experience remains consistent and fluid. This adaptability is crucial for users who are constantly on the move.

Navigation Efficiency: The navigation within their interface is designed for efficiency. Users can quickly access their accounts, transfer funds, or view their transaction history with minimal clicks. This ease of navigation is a core element of the platform’s user-friendly design.

Customization: Relay Bank understands that every user has unique needs. Thus, it offers customization options, allowing users to tailor the dashboard to their preferences. Whether it’s rearranging widgets or setting up personalized alerts, these features make the banking experience more personal and relevant.

Visual Aesthetics: The visual design is both modern and appealing. The use of colors, fonts, and icons is carefully chosen to create a pleasant visual journey. This attention to aesthetics enhances the overall user experience, making banking tasks less mundane and more engaging.

Accessibility Features: They are committed to inclusivity, offering various accessibility features. This includes voice commands, screen reader compatibility, and adjustable text sizes, ensuring that the platform is accessible to users with different needs.

Security Measures in Relay Banking

In the digital age, security is a paramount concern, especially in the banking sector. Relay Bank understands this and has implemented robust security measures to ensure the safety and confidentiality of its customers’ information and transactions.

Advanced Encryption: They employ state-of-the-art encryption technology. This security measure ensures that all data transmitted between the user and the bank is encrypted, safeguarding sensitive information from unauthorized access.

Two-Factor Authentication (2FA): To enhance account security, they have integrated two-factor authentication. This requires users to provide two forms of identification before accessing their accounts, significantly reducing the risk of unauthorized access.

Regular Security Audits: Relay Bank conducts regular security audits to identify and address potential vulnerabilities. These proactive measures ensure that the bank’s security protocols remain robust against evolving cyber threats.

Secure Socket Layer (SSL) Certificates: The use of SSL certificates provides an additional layer of security. This feature is particularly important for online transactions, as it verifies the authenticity of the bank’s website and establishes a secure connection.

Real-Time Monitoring and Alerts: Their security system includes real-time monitoring of account activities. Any unusual or suspicious transactions trigger instant alerts to the user, allowing for swift action against potential fraud.

Customer Education: They also invest in educating its customers about security best practices. This includes tips on creating strong passwords, recognizing phishing attempts, and securing personal devices.

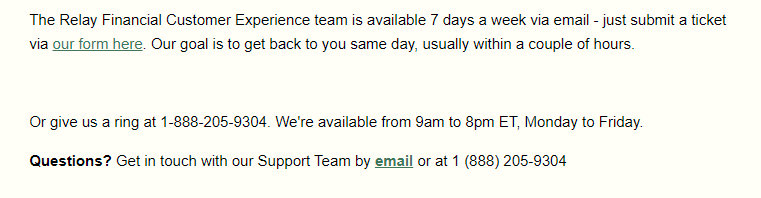

Customer Support and Service Quality

At the heart of any successful banking experience is exceptional customer support and service quality. Relay Bank recognizes this and has established a robust customer support system designed to address the needs and concerns of its clients efficiently and effectively.

7 Day Customer Support: Relay Bank offers round-the-clock customer service. Whether it’s a query about an account or assistance with a transaction, the bank’s support team is available 7 days a week. This continuous availability ensures that customers can get help whenever they need it.

Multiple Channels of Communication: Understanding the diverse preferences of its customers, provides various channels for customer support. This includes traditional methods like phone and email, as well as modern avenues like live chat and social media platforms. This multi-channel approach makes it convenient for customers to reach out in the way that suits them best.

Trained and Knowledgeable Staff: The customer support team is not only friendly but also highly trained and knowledgeable. They are equipped to handle a wide range of queries, from simple account questions to more complex financial inquiries, ensuring that customers receive accurate and helpful information.

Feedback and Continuous Improvement: Relay Bank values customer feedback as a key tool for continuous improvement. Regular surveys and feedback mechanisms are in place to gauge customer satisfaction and identify areas for enhancement. This ongoing commitment to improvement reflects the bank’s dedication to service quality.

Speed and Efficiency: In today’s fast-paced world, efficiency is critical. Relay Bank strives to minimize wait times and streamline support processes to ensure quick and effective resolution of customer queries.

Personalized Service: Recognizing that each customer is unique, they aim to provide personalized service. Whether it’s understanding individual financial needs or remembering personal preferences, this personalized approach adds a human touch to digital banking.

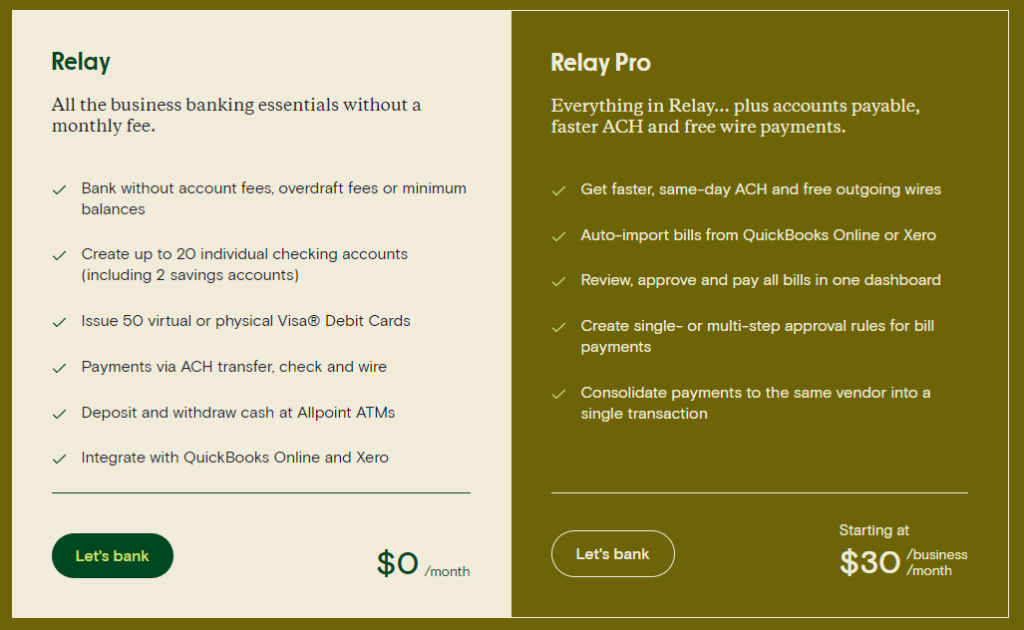

Fee Structure and Pricing

Understanding the fee structure and pricing is crucial for customers when choosing a banking service. Relay Bank stands out for its transparent and customer-friendly fee policy. Let’s delve into the specifics that make the fee structure both competitive and clear.

Transparent Pricing: One of the core principles is transparency in pricing. This means no hidden fees or unexpected charges. Customers are provided with a detailed breakdown of all fees associated with their accounts and services, ensuring they are fully informed about any charges they may incur.

Competitive Account Fees: Relay Bank offers competitive fees for account maintenance, transfers, and other standard banking operations. The aim is to provide high-quality banking services at a cost that is accessible and fair to a wide range of customers.

Customizable Plans: Recognizing that different customers have varying needs, Relay Bank provides customizable plans. Whether you are a frequent user who needs a high number of transactions or someone who prefers a more basic banking service, there are options to suit each customer’s requirements and budget.

Fee Waivers and Discounts: To add value for their customers, they often includes fee waivers and discounts as part of their promotional offers. For instance, maintaining a certain minimum balance might result in reduced or waived maintenance fees, offering a great incentive for customers.

Clarity on International Transaction Fees: For customers who travel or conduct business internationally, Relay Bank clearly outlines its fees for international transactions. This clarity helps customers manage their finances more effectively and avoid any surprises when using their accounts abroad.

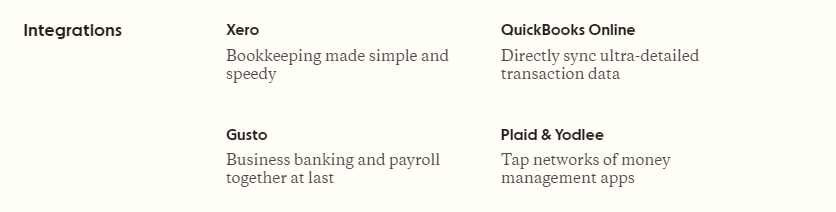

Integration with Other Financial Tools

Relay Bank’s commitment to convenience and efficiency is highlighted through its integration with various leading financial tools. This integration capability positions them as a versatile choice for users seeking a cohesive financial management experience.

Xero Integration:

- Seamless Connection with Xero: Relay Bank offers a direct integration with Xero, simplifying the process of managing business finances. This integration allows for real-time updates and synchronization of financial data between Relay Bank and Xero.

- User-Friendly Features: Features such as editing your Xero integration, manually syncing your Xero bank feed, resetting your Xero bank feed, and troubleshooting are all part of Relay Bank’s suite. These options ensure that the integration process is smooth and user-centric.

QuickBooks Integration:

- Effortless Bank Feeds with QuickBooks: Integrating Relay Bank with QuickBooks for bank feeds streamlines the accounting process, ensuring that transaction data is accurately and efficiently recorded in QuickBooks.

Gusto Integration:

- Relay and Gusto for Payroll: The integration with Gusto provides a seamless payroll management experience, making it easier for businesses to handle employee payments and financial records.

Compatibility with Multiple Platforms:

- Relay Bank’s versatile nature is further underscored by its compatibility with a range of platforms. Whether it’s exporting account statements to Hubdoc, Receipt Bank, or similar tools, Relay Bank ensures smooth data transfer and synchronization.

Alternatives to Traditional Payment Methods:

- PayPal and Other Payment Solutions: Recognizing the need for diverse payment options, Relay Bank offers alternatives to traditional methods like Zelle. The connection with platforms like PayPal allows users to manage various payment channels efficiently.

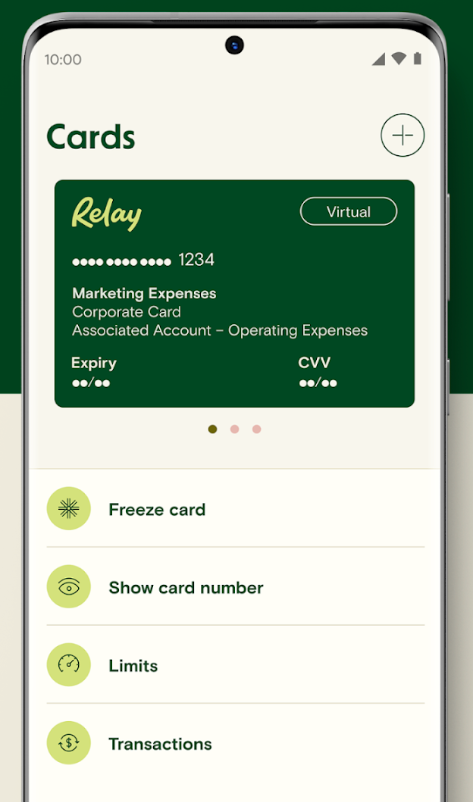

Mobile Banking Capabilities

In the era of smartphones, mobile banking capabilities are a crucial aspect of any financial institution. Relay Bank, recognizing this need, offers a robust and user-friendly mobile banking experience. This focus on mobile banking ensures that customers can manage their finances conveniently from anywhere, at any time.

Comprehensive Mobile App: Relay Bank’s mobile app is designed to offer a full range of banking services. Users can check balances, transfer funds, pay bills, and deposit checks, all from their mobile device. The app’s intuitive design makes these tasks simple and efficient.

Real-Time Alerts and Notifications: The mobile app provides real-time alerts for various activities such as low balance warnings, large transactions, and suspicious activity. These notifications keep users informed and in control of their accounts.

Enhanced Security on Mobile: Relay Bank places a high priority on mobile security. Features like fingerprint and facial recognition ensure that access to the mobile banking app is secure yet convenient.

Mobile Check Deposit: One of the standout features is mobile check deposit. Users can deposit checks by simply taking a picture with their smartphone, saving time and eliminating the need to visit a branch or ATM.

Seamless User Interface: The mobile app boasts a seamless user interface, consistent with Relay Bank’s web platform. This continuity ensures a familiar and comfortable experience for users switching between devices.

Accessibility Features: The app includes various accessibility features, making mobile banking inclusive for all customers. This includes voice commands and screen reader compatibility.

Customer Reviews and Feedback

In the digital banking sector, customer reviews and feedback are invaluable assets. They provide insights into the real-world experiences of users, highlighting the strengths and areas for improvement. Relay Bank has garnered attention for its customer-centric approach, and this is reflected in the customer reviews and feedback it receives. Go here to view customer testimonials!

Positive Reviews: Many customers praise Relay Bank for its ease of use, robust security measures, and exceptional customer service. Users often highlight how Relay Bank’s intuitive interface and innovative features have simplified their banking experience, making financial management more accessible and less time-consuming.

Constructive Feedback: Alongside positive remarks, Relay Bank also welcomes constructive feedback. This includes suggestions for new features, enhancements to existing services, and recommendations for a more personalized banking experience. Relay Bank views this feedback as an opportunity for growth and continuously works to refine its offerings.

Responsive to Customer Needs: What sets Relay Bank apart is its responsiveness to customer feedback. The bank actively listens to its users and implements changes based on their suggestions. This approach not only improves the service quality but also builds a loyal customer base.

Impact on Service Development: Customer feedback directly influences the development of new features and services at Relay Bank. By understanding the needs and preferences of its users, the bank can tailor its offerings to meet the evolving demands of the market.

Transparency in Reviews: Relay Bank maintains transparency in its customer reviews and feedback. This openness not only fosters trust but also provides prospective customers with a clear picture of what to expect from the bank.

Relay Bank vs. Traditional Banks

In the evolving landscape of banking, the contrast between innovative digital banking solutions like Relay Bank and traditional banks is increasingly prominent. Understanding these differences is key for customers choosing the right banking partner.

Technology and Innovation: Relay Bank stands out for its adoption of cutting-edge technology. Unlike many traditional banks, Relay Bank’s platform is designed with the latest digital trends in mind, offering a more intuitive and user-friendly experience.

Ease of Access: Digital banking with Relay Bank offers unparalleled ease of access. Customers can manage their finances anytime and anywhere, a convenience that traditional banks, with their reliance on physical branches, often cannot match.

Fee Structure: One of the most notable differences lies in the fee structure. Relay Bank typically offers more transparent and often lower fees compared to traditional banks, which may have complex fee structures with various charges.

Customer Service: While traditional banks offer in-person service, Relay Bank provides efficient and prompt customer support through digital channels. This can often result in quicker resolutions and a more convenient experience for tech-savvy customers.

Security: Both Relay Bank and traditional banks prioritize security, but the methods and technologies employed may differ. Relay Bank utilizes modern digital security measures like advanced encryption and two-factor authentication, which are especially suited to online banking.

Flexibility and Personalization: Digital banks like Relay Bank often offer greater flexibility and personalization in their services. They are typically more agile in updating and introducing features to meet the evolving needs of customers.

Environmental Impact: Digital banks generally have a smaller environmental footprint due to less reliance on physical infrastructure and paperless operations, which is an increasingly important consideration for many customers.

Tips for Maximizing Benefits with Relay Bank

Maximizing the benefits of Relay Bank involves more than just managing day-to-day transactions. By leveraging the unique features and capabilities of Relay Bank, customers can enhance their financial management and gain more from their banking experience.

1. Bi-Weekly Webinar: They will walk you through how business banking impacts cash management and how Relay helps you stay on the money.

- A case study walkthrough of how traditional banking can disrupt your small business (and how to avoid such disruptions)

- How to compartmentalize income, expenses and cash reserves into separate checking accounts

- How to use Relay’s collaboration features to delegate administrative work securely

- How to improve financial visibility with detailed data about every incoming and outgoing transaction

- The exact steps to implement a smart cash management system using Relay

2. Explore All Available Features: Make sure to explore all the features Relay Bank offers. From budgeting tools to savings goals, utilizing these features can help you better manage and track your financial health.

3. Set Up Alerts and Notifications: Use Relay Bank’s alert system to stay informed about your account activity. Setting up notifications for transactions, low balances, or unusual activity can help in managing your account more proactively and avoiding potential issues.

4. Regularly Review Account Statements: Make it a habit to review your account statements regularly through Relay Bank. This not only helps in keeping track of your spending but also in spotting any discrepancies early.

5. Leverage Integrations with Financial Tools: If you use financial management software like QuickBooks or Xero, integrate them with your Relay Bank account. This integration can streamline your accounting processes, making financial management more seamless.

6. Engage with Customer Support for Financial Advice: Don’t hesitate to contact Relay Bank’s customer support for advice or clarification on banking features. Their expertise can provide valuable insights into making the most of your banking experience.

7. Stay Informed About New Features and Updates: Keep an eye on updates and new features introduced by Relay Bank. Staying informed ensures that you are making the most of the latest financial tools and services available.

History and Development of Relay Banking

Understanding the history and development of Relay Bank provides insight into its evolution and commitment to innovation in the financial sector. This journey highlights how Relay Bank has grown to meet the changing needs of its customers.

The Inception of Relay Bank: Relay Bank’s story began with a vision to simplify banking by leveraging technology. The founders aimed to create a platform that was not only user-friendly but also provided advanced financial solutions to both individuals and businesses.

Early Development: The initial phase focused on developing a robust digital infrastructure. This involved integrating cutting-edge technologies to ensure a secure, efficient, and accessible banking experience. The emphasis was on creating an intuitive interface that catered to the tech-savvy generation.

Expansion of Services: Over time, Relay Bank expanded its services. Initially starting with basic banking features, it gradually included more complex financial tools such as investment options, international transfers, and business accounting integrations.

Adapting to Customer Needs: A significant part of Relay Bank’s development has been its adaptability to customer feedback. The bank continuously refined and added features based on user input, ensuring that its services remained relevant and customer-centric.

Growth and Partnerships: Relay Bank’s growth is also marked by strategic partnerships and collaborations. These alliances with tech companies and financial institutions have broadened its service offerings and enhanced its technological capabilities.

Current Status: Today, Relay Bank stands as a testament to innovative banking, offering a comprehensive suite of services that cater to a diverse customer base. Its commitment to continuous improvement and customer satisfaction remains at the core of its operations.

Conclusion and Final Thoughts

As we’ve explored throughout this post, Relay Bank stands out as a beacon of innovation and customer-centricity in the digital banking landscape. From its intuitive user interface and top-notch security measures to its seamless integration with other financial tools and commitment to excellent customer support, Relay Bank has proven itself to be more than just a bank; it’s a comprehensive financial partner.

The journey of Relay Bank, from its humble beginnings to its current status as a leader in digital banking, reflects its dedication to adapting and growing with the needs of its customers. Whether you’re an individual looking for an efficient way to manage personal finances or a business owner seeking streamlined financial processes, Relay Bank offers solutions tailored to your needs.

With its forward-thinking approach and continuous improvement, Relay Bank is not just keeping pace with the evolving world of finance; it’s setting new standards. For anyone navigating the complexities of modern banking and finance, Relay Bank emerges as a reliable, innovative, and user-friendly option.

In a world where financial management is becoming increasingly digital, choosing a bank like Relay Bank, which combines technological innovation with a strong customer focus, is more important than ever. As we’ve seen, Relay Bank is more than equipped to meet these challenges, offering a banking experience that is not only convenient and secure but also constantly evolving to meet the future head-on.