At Traffic TV, our goal is to assist you in maximizing the benefits of digital marketing and confidently making choices. To achieve this, we feature various programs from our partners where we receive commissions for purchases made through links in this post. However, be assured that this partnership does not affect our assessments. Learn more here

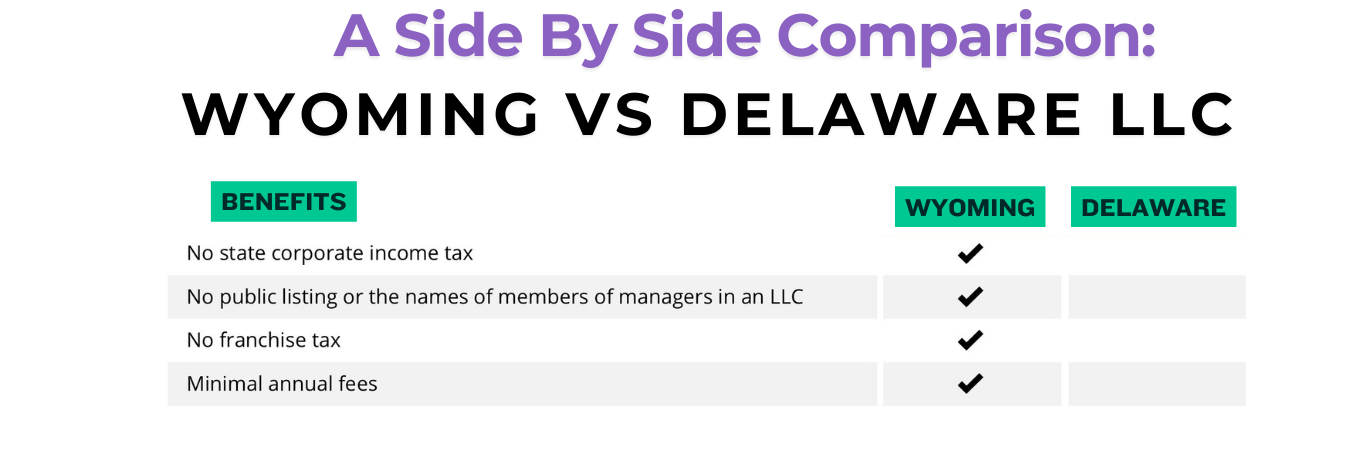

Starting an LLC can be a crucial step in building your business, and deciding between Wyoming vs Delaware LLC is a KEY DECISION for many entrepreneurs. Both states offer unique advantages, from tax benefits to privacy protections, but the right choice depends on your business needs and goals. In this blog post, we’ll compare the two options across essential factors to help you determine which state is the best fit for your LLC.

Table of Contents

Formation Costs

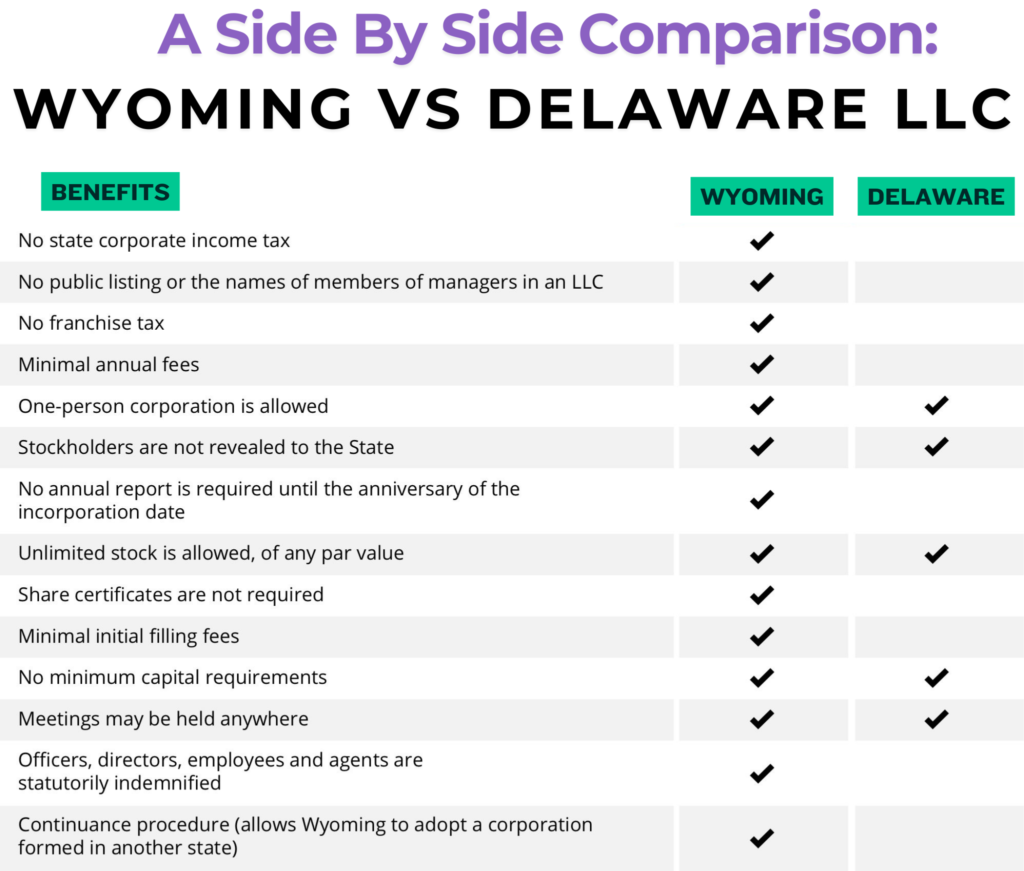

When deciding between a Wyoming and Delaware LLC, formation costs are an essential factor to consider. Both states have competitive pricing, but their fee structures differ, which can impact your choice depending on your budget and business goals.

In Wyoming, the initial filing fee for forming an LLC is relatively low, typically around $100. Additionally, Wyoming boasts lower ongoing costs, making it a cost-effective option for small businesses or startups looking to minimize expenses. This affordability has contributed to Wyoming’s growing popularity as a business-friendly state.

Delaware, on the other hand, charges a higher initial filing fee, usually around $90 to $300, depending on the type of LLC you form and the speed of processing you choose. While the upfront cost may not seem drastically different, Delaware’s ongoing fees, such as franchise taxes and registered agent fees, are generally higher than those in Wyoming. These additional costs can add up over time, especially for small businesses.

Ultimately, if formation costs are a deciding factor for you, Wyoming may offer a more budget-friendly option. However, the benefits of forming a Delaware LLC, such as its renowned legal system, might justify the higher costs for certain businesses.

Annual Fees and Maintenance

When comparing Wyoming vs Delaware LLC, understanding the annual fees and maintenance costs is crucial. These ongoing costs can significantly impact the long-term affordability of your LLC.

In Wyoming, the annual fees are relatively low, with a flat $60 annual report fee for most LLCs. This affordability is one of the reasons many small businesses and entrepreneurs choose Wyoming. Additionally, Wyoming has minimal ongoing requirements, which means less administrative work and fewer costs related to compliance.

Delaware, on the other hand, has higher annual maintenance costs. LLCs in Delaware are required to pay a $300 franchise tax annually. While this flat fee is straightforward, it’s notably higher than Wyoming’s annual costs. Delaware also has more rigorous compliance requirements, which may result in additional expenses if you need legal or professional assistance to stay compliant.

For businesses focused on minimizing ongoing expenses, Wyoming is generally the more cost-effective choice. However, for companies seeking Delaware’s reputation and legal advantages, the higher costs might be worth the investment.

Tax Benefits

One of the most significant considerations when choosing between Wyoming vs Delaware LLC is the tax benefits each state offers. Both states are known for being business-friendly, but their tax structures have distinct differences that could influence your decision.

Wyoming is often celebrated for its tax advantages. The state does not impose any corporate income tax, franchise tax, or personal income tax. This makes Wyoming an attractive choice for LLCs looking to minimize tax obligations. Additionally, there is no inventory tax, which can be a significant advantage for businesses dealing with physical goods.

Delaware, on the other hand, does not impose sales tax, which can be beneficial for certain types of businesses. However, Delaware does require LLCs to pay a $300 annual franchise tax, regardless of income. Unlike Wyoming, Delaware has a more complex tax structure, which includes taxes on corporate income for entities operating within the state. Despite this, many businesses still choose Delaware for its legal and financial benefits, particularly those planning to raise capital or expand internationally.

If minimizing taxes is your top priority, Wyoming may be the better option. However, Delaware’s tax benefits may appeal to businesses leveraging its legal system and reputation.

Privacy and Anonymity

When evaluating Wyoming vs Delaware LLC, privacy and anonymity are critical factors to consider, especially for business owners who value discretion and security.

Wyoming is often regarded as one of the most privacy-friendly states for LLC formation. It does not require the names of members or managers to be publicly disclosed in formation documents. Additionally, Wyoming offers strong protections for anonymity by allowing the use of nominee managers, further shielding the identity of business owners.

Delaware, while known for its robust legal protections, is less focused on privacy than Wyoming. Although Delaware does not require the disclosure of members’ names in public records, it does require the registered agent to keep detailed records, including the names of LLC members and managers. These records are not publicly accessible but must be provided upon request by the state.

For entrepreneurs prioritizing maximum privacy and anonymity, Wyoming is often the preferred choice. However, Delaware’s confidentiality measures are still suitable for many businesses, particularly those valuing its legal reputation over absolute anonymity.

Business Environment and Laws

When comparing Wyoming vs Delaware LLC, the business environment and legal framework in each state play a significant role in the decision-making process. Both states are renowned for their business-friendly approaches, but they cater to different types of entrepreneurs and businesses.

Wyoming is often favored by small businesses and startups due to its straightforward legal framework and minimal regulatory burden. The state consistently ranks as one of the most business-friendly in the U.S., thanks to its low fees, lack of income taxes, and simplified compliance requirements. Wyoming’s laws are designed to offer flexibility in LLC management and operations, making it an excellent choice for business owners seeking ease and affordability.

Delaware, on the other hand, is internationally recognized for its sophisticated legal system and extensive corporate laws. The state’s Court of Chancery, which specializes in corporate law, provides businesses with a predictable and efficient legal environment. This has made Delaware the preferred choice for larger businesses, especially those seeking venture capital or planning to go public. While the legal benefits in Delaware are unmatched, they may not be as relevant or necessary for smaller businesses or sole proprietorships.

In summary, if you prioritize a straightforward and low-cost business environment, Wyoming might be your best bet. For companies aiming to leverage a robust legal system and attract investors, Delaware is likely the better option.

Asset Protection

Wyoming provides strong asset protection through its charging order statute, which is designed to safeguard business owners from creditors. Under this statute, creditors can only access distributions made to the debtor, not the LLC’s underlying assets or ownership. This feature makes Wyoming particularly appealing for those prioritizing personal and business asset security.

Delaware also offers reliable asset protection, with a focus on flexibility and dispute resolution among LLC members. While its legal framework is highly respected, Wyoming’s simplified and comprehensive statutes often make it the preferred choice for entrepreneurs solely concerned with protecting their assets.

In conclusion, while both states provide solid asset protection, Wyoming is often the better option for individuals focused on minimizing risk and securing their investments. Delaware, however, remains a strong choice for larger businesses leveraging its broader legal advantages.

State-Specific Requirements

When comparing Wyoming vs Delaware LLC, understanding state-specific requirements is essential to ensure compliance and smooth operation of your business. Both states have distinct rules that can influence your decision based on the complexity and nature of your business.

Wyoming has straightforward and minimal requirements for LLC formation and maintenance. To form an LLC in Wyoming, you need to file Articles of Organization and appoint a registered agent with a physical address in the state. The annual report fee is a flat $60 for most businesses, and the state does not require public disclosure of member or manager names, offering added privacy. Additionally, there is no requirement to file detailed financial reports.

Delaware, on the other hand, has more detailed compliance requirements. Forming an LLC in Delaware involves filing a Certificate of Formation and appointing a registered agent within the state. While Delaware does not require member or manager names in the Certificate of Formation, LLCs must maintain an operating agreement and detailed records, which can add administrative complexity. Furthermore, Delaware LLCs must pay a $300 annual franchise tax, which is higher than Wyoming’s fees.

In summary, if you’re seeking simplicity and minimal state-specific requirements, Wyoming may be the better option. Delaware, however, offers a more structured framework that can benefit larger or more complex businesses.

Resident Agent Requirements

When choosing between Wyoming vs Delaware LLC, understanding resident agent requirements is a key consideration. A resident agent, also known as a registered agent, is a mandatory element of forming and maintaining an LLC in both states.

Wyoming requires all LLCs to designate a resident agent who has a physical address in the state. This agent is responsible for accepting legal documents and official correspondence on behalf of the LLC. Wyoming allows for flexibility, as the registered agent can be a business entity authorized to operate in Wyoming or an individual who resides in the state. The simplicity of Wyoming’s requirements makes it easy for business owners to comply, whether they use a professional service or appoint themselves if they meet the criteria.

Delaware has similar resident agent requirements, mandating that all LLCs maintain a registered agent with a physical address within the state. Delaware, however, has a more extensive network of professional resident agent services, which is often utilized by businesses due to the state’s popularity among corporations. Like Wyoming, the registered agent’s role is to handle legal and state-related documents, ensuring compliance with state regulations.

While the resident agent requirements are straightforward in both states, Delaware’s expansive professional services may appeal to larger businesses, whereas Wyoming offers a simpler and cost-effective approach for smaller LLCs.

Popularity Among Startups

Wyoming is gaining momentum as a top choice for startups, particularly small businesses and solo entrepreneurs. The state’s low formation and maintenance costs, coupled with its robust asset protection and privacy features, make it an ideal option for cost-conscious startups. Wyoming’s straightforward compliance requirements also reduce administrative burdens, allowing new business owners to focus on growth instead of paperwork.

Delaware, on the other hand, has long been a go-to state for larger startups and companies seeking venture capital or planning to go public. Its advanced legal framework, particularly the Court of Chancery, provides unparalleled support for resolving corporate disputes. Delaware’s reputation among investors and legal professionals makes it a preferred choice for startups in technology, finance, and other high-growth industries aiming to attract significant funding.

In summary, Wyoming is increasingly popular for its affordability and simplicity, making it ideal for small startups. Delaware remains the leader for larger, investor-driven startups that benefit from its robust legal and financial ecosystem.

Bizee’s LLC Formation Services: Why Choose Bizee?

If you’re deciding between Wyoming vs Delaware LLC, navigating the formation process can feel overwhelming. That’s where Bizee comes in. Bizee specializes in making LLC formation simple, efficient, and affordable, whether you choose Wyoming, Delaware, or another state.

Ease of Use

Bizee’s streamlined platform guides you through each step of the LLC formation process. From filing the necessary paperwork to ensuring compliance with state-specific requirements, Bizee takes the guesswork out of forming your business.

Affordable Pricing

Bizee offers competitive pricing with no hidden fees. Whether you’re starting a low-cost Wyoming LLC or opting for Delaware’s investor-friendly framework, Bizee provides a transparent breakdown of costs to help you make an informed decision.

Comprehensive Services

Beyond LLC formation, Bizee provides additional services like resident agent support, annual report filing, and compliance monitoring. These services ensure that your LLC remains in good standing, no matter which state you choose.

Expert Support

Bizee’s experienced team is available to answer your questions and provide guidance. Whether you’re weighing the benefits of Wyoming’s privacy features or Delaware’s legal reputation, Bizee’s experts can help you make the right choice for your business.

Why Bizee Stands Out

Choosing between Wyoming vs Delaware LLC is an important decision, and Bizee ensures that the process is tailored to your needs. With Bizee, you gain a trusted partner dedicated to helping you build and grow your business with confidence.

Final Thoughts: Wyoming vs Delaware LLC

Choosing between Wyoming vs Delaware LLC ultimately depends on your business needs, priorities, and future goals. Both states are recognized for their business-friendly policies, but they cater to different types of entrepreneurs and organizations.

Wyoming shines with its affordability, simplicity, and strong privacy protections, making it an ideal choice for small businesses, solo entrepreneurs, and those prioritizing asset protection. Its low annual fees and straightforward compliance requirements are particularly appealing to startups aiming to minimize costs while maintaining flexibility.

Delaware, on the other hand, stands out for its sophisticated legal framework and reputation, especially among larger companies and investor-backed startups. Its Court of Chancery, specialized corporate laws, and appeal to venture capitalists make it the preferred state for businesses planning significant growth or seeking funding.

While both states have unique strengths, your decision should be guided by your business type, budget, and long-term strategy. Whether you value Wyoming’s cost-effectiveness or Delaware’s legal and financial ecosystem, you can build a strong foundation for your LLC in either state.

Why Bizee is the Right Partner for Your LLC Formation

Regardless of the state you choose, partnering with Bizee simplifies the LLC formation process. From understanding state-specific requirements to ensuring compliance, Bizee’s expertise and affordable services make starting your business easy and stress-free. Let Bizee help you take the next step in building your dream business with confidence and clarity.

By understanding the distinctions between Wyoming vs Delaware LLC, you’re already ahead in making an informed decision. Choose the state that aligns with your business goals, and let Bizee handle the rest!